Q2 2025 Case Study: Value-Add Execution at Hughes Airport Center

- BKM Capital Partners

- Jul 7, 2025

- 3 min read

Updated: Oct 29, 2025

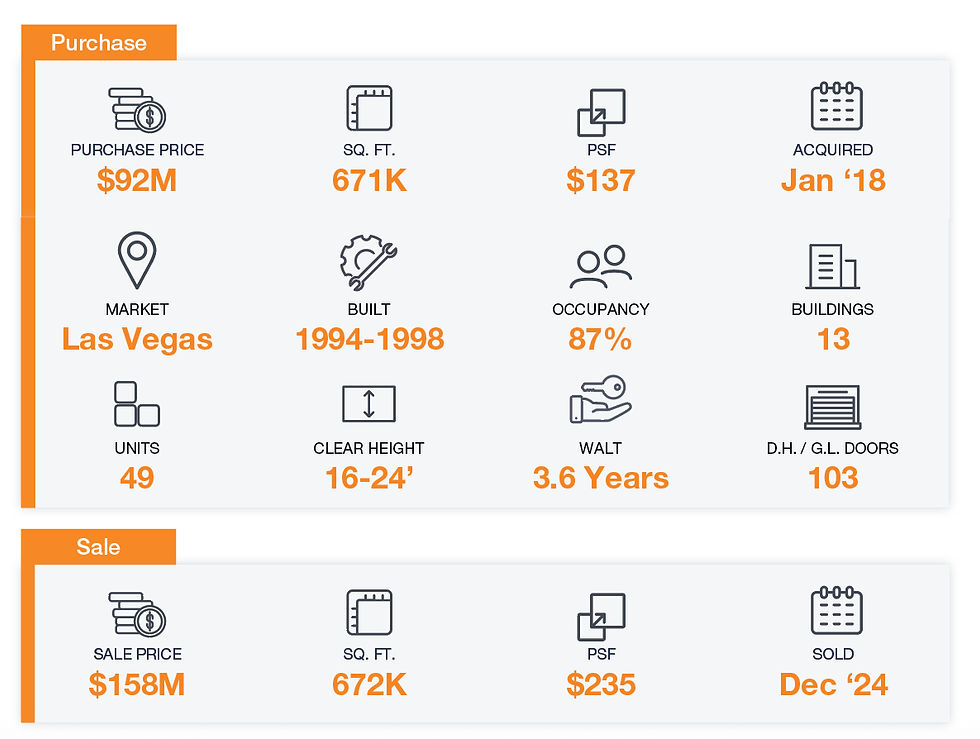

Get an exclusive look into BKM's impressive property transformation at this 671K SF asset in Las Vegas, NV.

PROPERTY OVERVIEW

Located just minutes from McCarran International Airport and adjacent to both I-15 and I-215, the 670,902-square-foot campus encompasses 13 buildings with a mix of industrial and service uses.

With over 59% office buildout across the asset, BKM recognized an opportunity to reduce obsolescent office-heavy suites and convert them into more flexible, logistics-friendly industrial space.

OPPORTUNITY

Aesthetic Appeal:

Highly functional construction and strategic airport location position the property as a “best in class” asset.

The addition of tactical cosmetic upgrades such as new paint and a comprehensive landscape renovation further increase curb appeal and visibility.

Outdated office configurations and overbuilt industrial spaces allow reconfiguration into flexible, modern suites designed to appeal to a broad spectrum of local tenants.

Financial Appeal:

Rents achieved during escrow were already 14% above underwriting, and the asset was secured at a 7% going-in cap rate—well above the 6.1% cap rate at contract—highlighting its compelling value.

Opportunity to benefit from a 10.3% cash-on-cash return through the hold, ultimately contributing to 49% of total investment profit.

Industrial vacancy was sub 4% at acquisition, reflecting strong market fundamentals and a persistent shortage of small-bay construction.

NEARBY BKM PROPERTIES

WHY WE LOVED THIS DEAL

Numerous factors lead BKM to pursue the deal, including attractive repositioning opportunities and a strategic location.

Conversion Potential: Over 28,000 SF of dysfunctional space was identified for conversion, providing immediate opportunities to drive NOI through suite repositioning and increased efficiency.

Location: Strategically located near McCarran International Airport with direct access to I-15 and I-215, offering ideal last-mile positioning for logistics, service, and distribution users.

Lease Term Stability: A weighted average lease term (WALT) of 3.6 years provides reliable income while enabling staggered mark-to-market adjustments throughout the hold period.

Tenant Base: The park featured a diverse rent roll, with 41 tenants across 670,902 square feet and no single tenant occupying more than 6.2% of NRA—minimizing rollover risk and enhancing income durability.

MARKET DYNAMICS

The Las Vegas metro reached a population of 2.3 million by year-end 2024, reflecting 16.2% growth over the past decade—making it one of the fastest-growing markets in the U.S.

The region’s industrial footprint spans over 194 million square feet, with 8.2 million SF currently under construction, signaling sustained developer confidence.

Vacancy is at 9.8%, driven in large part by newly delivered product that has yet to stabilize.

Asking rents average $14.31/SF, with 4.4 million SF of net absorption YoY. Rates have grown 106% in the past decade, indicating consistent demand for the product type.

Industrial investment activity remains robust, with $1.1 billion in 2024 transaction volume and an average sale price of $192/SF, highlighting the market’s increasing appeal to institutional capital targeting yield and diversification.

FOCUS ON GROWTH - SIC CODES

The BKM team seeks to continuously diversify its tenant mix, aligning with its growth strategy to mitigate risk and hedge against industry-specific volatility.

EXECUTION PLAN

Total CapEx: $9.2M capital improvement program focused on functionality, tenant experience, and long-term value creation.

Tenant Improvements: $3.9M in tenant improvements, plus $1.3M in speculative TI’s to modernize and reconfigure leasable space.

Building Systems: $1.9M allocated to roofing, HVAC, fire/life safety, and façade upgrades.

Cosmetic Enhancements: $880K invested in exterior paint, signage, landscaping, and parking lot improvements to boost curb appeal.

Exterior Improvements

Interior Improvements

PROPERTY TRANSFORMATION

RESULTS

BKM’s strategic value-add approach has delivered exceptional operating and leasing outcomes at Hughes Airport Center, showcasing the successful execution of its business plan and its proven ability to generate strong returns for investors.

41% increase in NOI between 2018 and 2024.

96% average occupancy during the hold period.

14% average annual mark-to-market increases on lease expirations between 2020 and 2024.

45% increase in in-place rents between acquisition and disposition, with average in-place rents of $0.97/ft in 2018, and $1.41/ft in 2024.

77% of NRA was signed at or above MLA by the end of the hold.

88 total leases executed at the project by the BKM team between 2018-2024, reflecting the operational intensity of managing multi-tenant industrial assets.

Units at the property average 3-6 months downtime, with MLA’s hovering around 6-9 months.

260,434 square feet of rollovers were executed across 30 suites throughout the hold, which equates to about 38% of NRA.

71% appreciation in property value between the purchase and exit of the asset.

To download and view the full case study, click here.

Comments